Understanding Modern Buyer Behavior and What It Means for Advertisers

Many B2B marketing teams are seeing a familiar pattern. Marketing Qualified Lead volume is trending down, yet sales conversations feel more productive, deal quality is improving, and downstream conversion rates are holding steady or rising.

At first glance, this looks like a funnel problem. In reality, it is more often a visibility problem.

Buyer behavior has changed, and the way demand shows up today looks very different than it did even a few years ago.

Why MQL Volume Is Declining Across B2B Marketing

A decline in MQLs does not automatically signal weaker demand. It usually reflects how buyers prefer to engage earlier in the buying process.

In fact, recent data shows that four out of five B2B buyers wait until they are roughly 70 % of the way through evaluating their options before they reach out to a vendor, and more than 80 % have already narrowed their choice by then.

Today’s buyers self-educate quietly. They research independently, compare vendors on their own terms, revisit topics multiple times, and validate decisions internally long before they are ready to complete a form or speak with sales. Much of the decision-making happens anonymously.

In this environment, the form fill has become a late-stage signal. By the time someone raises their hand, they often already understand the landscape, have narrowed their options, and are moving toward action. That makes MQLs a lagging indicator rather than an early measure of interest.

The Problem With Relying on MQLs as the Primary Demand Metric

When teams rely too heavily on MQL volume to define success, this shift creates tension. Fewer early hand-raisers make it appear as though demand is shrinking, even when engagement across content, media, and research channels remains strong.

What often goes unseen includes:

- Repeated visits to the same topic or category

- Consumption of multiple pieces of related content

- Return sessions across days or weeks

- Cross-channel engagement within a short timeframe

This activity reflects genuine buying interest, but it does not fit neatly into traditional funnel reporting. Without visibility into this behavior, marketing appears less effective than it actually is, and sales teams lose valuable early context.

How Early-Stage Engagement Signals Reveal Real Buying Intent

Understanding demand today requires seeing what happens before the form fill. More than 75% of B2B buyers will do their own research before they ever agree to talk with a salesperson, underscoring how much of the decision happens before any form completion.

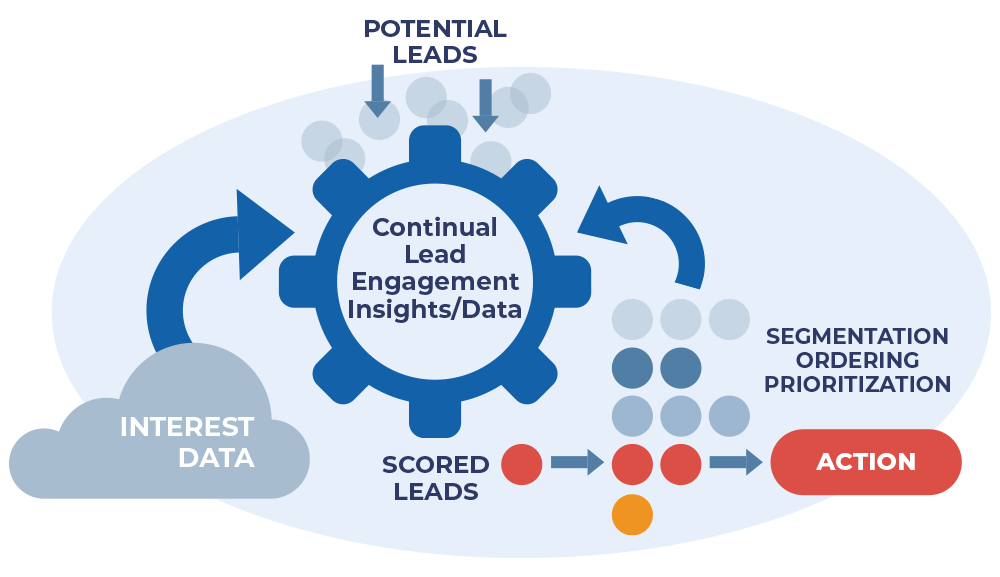

IgniteDemand was built to surface these upstream signals by tracking engagement across BNP Media brands and identifying behavioral patterns that indicate growing intent. Instead of focusing on a single action, it looks at how buyers move through content over time.

Signals such as repeated topic visits, deeper content consumption, and frequent return sessions provide a clearer picture of who is actively researching and how close they may be to a decision. These insights emerge well before someone converts, giving both marketing and sales earlier awareness of real demand.

What This Means for Advertisers and Sales Teams

As many organizations see SQL volume rise while MQL volume declines, the teams with stronger early-intent visibility are better positioned to respond.

With a clearer understanding of how buyers engage across trusted industry media, sales outreach can align with actual behavior rather than outdated funnel assumptions. Marketing can also demonstrate demand more accurately by showing the full journey, not just the moment a form is completed.

This shift allows advertisers to:

- Identify in-market accounts earlier

- Prioritize outreach based on real engagement patterns

- Align messaging with active research topics

- Reduce reliance on top-of-funnel form volume as the primary success metric

Seeing Demand Differently Moving Forward

Changes in inbound behavior do not have to create uncertainty. They call for better ways of seeing demand as it develops.

If you are interested in how IgniteDemand identifies early-stage engagement and translates behavioral patterns into sales-ready opportunities, the BNP Media team can walk through example scoring paths and real-world use cases.

Understanding demand earlier helps teams move with buyers instead of waiting for them to raise their hand.